Withum has a dedicated team of ERC experts who can assist with preparing or reviewing your ERC claim, representing you before the IRS if your ERC claim is audited, and acting as an expert witness in civil or criminal investigations involving the ERC. Additionally, if a tax practitioner learns that a current client did not comply with the ERC requirements in a prior tax year, the practitioner is expected to promptly inform the client of the noncompliance, error, or omission and any penalties that may apply.

#IRS CONTACT US CODE#

3 Section 7803 of the Internal Revenue Code 4 provides for the appointment of a. 2 The office of Commissioner was created by Congress as part of the Revenue Act of 1862. The perpetuation of an improper ERC claim can result from the filing of the claim itself or by preparing an original or amended income tax return to reduce wage or health plan expense deductions by the amount of the ERC. The Commissioner of Internal Revenue is the head of the Internal Revenue Service (IRS), 1 an agency within the United States Department of the Treasury. Please note that this team cannot answer questions related to State Policy or Procedure, but can assist you on finding the proper contact information for. Late-Winter Storms Hit the East and West. Sources: The Hill, Newsmax, CNBC RECENT PRAYER UPDATES. The notice reminds tax professionals that they must be diligent as to the accuracy of ERC claims and should not prepare an original or amended tax return that claims or perpetuates a potentially improper ERC claim. For IRS officials as they work to process the backlog of tax returns.

#IRS CONTACT US PRO#

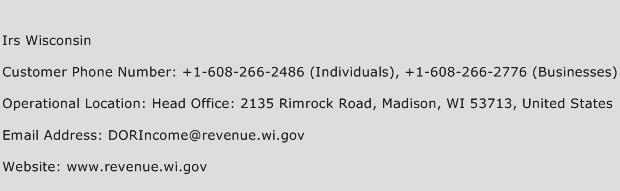

If youre a tax pro who needs to contact the IRS, use these numbers.

#IRS CONTACT US PROFESSIONAL#

Also on March 7, 2023, the IRS’s Office of Professional Responsibility (OPR) issued a warning to tax professionals regarding the ERC. The IRS issued a press release with a renewed warning to taxpayers regarding claims for the Employee Retention Credit (ERC) on March 7, 2023. The IRS also has specific phone numbers for tax professionals.

0 kommentar(er)

0 kommentar(er)